2/27/23 - Energy Market Trading Journal - Gain of $155 / 4.5%

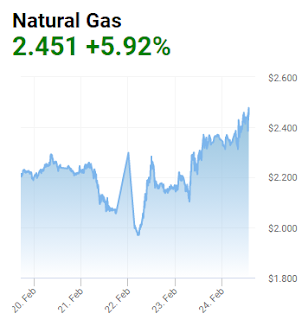

Today was another easy day, but I also timed it well. The market topped pretty early, and I sold early, around 9am. All in All, BOIL wentu p 8.6% today so I could have made more money if I didn't sell so early, but I didn't want to be greedy. My thought was that if I can end my day at 9am up 160 dollars I may as well since I am not sure when It's going to draw back. Perhaps tomorrow? I am currently holding $3,547 in BOIL, and $2,641 in KOLD.. In the morning, I will look at what the early-market trading is looking like, and sell one of them based on the trend. If I am wrong, I will sell the other before my losses hit $150. My guess is that KOLD will be the winner tomorrow. since I am starting to see a drop in after-hours trading. I also think we are currently at a resistance point, and losing momentum.